Feie Calculator Can Be Fun For Everyone

Table of ContentsFeie Calculator for BeginnersFeie Calculator for BeginnersLittle Known Facts About Feie Calculator.The smart Trick of Feie Calculator That Nobody is Talking AboutFeie Calculator - The Facts

Tax obligation decrease in the USA The USA tax obligations citizens and homeowners on their around the world income. Citizens and citizens living and working outside the united state might be qualified to a foreign earned revenue exclusion that lowers taxed income. For 2025, the optimal exclusion is $130,000 per taxpayer (future years indexed for inflation)Additionally, the taxpayer needs to satisfy either of two tests:: the taxpayer was an authentic resident of an international nation for a duration that includes a complete united state tax obligation year, or: the taxpayer must be physically present in an international nation (or nations) for at the very least 330 complete days in any kind of 12-month duration that starts or finishes in the tax year in concern.

Better, the test is not met if the taxpayer proclaims to the international federal government that they are not a tax obligation citizen of that country. Such statement can be on visa applications or tax returns, or enforced as a condition of a visa. Eligibility for the exemption might be influenced by some tax obligation treaties.

The "housing exemption" is the quantity of housing expenditures in unwanted of 16% of the exclusion limitation, computed on an everyday basis. It is additionally based upon the number of qualifying days, and is restricted to a certain dollar quantity based on the place of real estate. The exemption is limited to revenue made by a taxpayer for performance of solutions outside the U.S.

Not known Facts About Feie Calculator

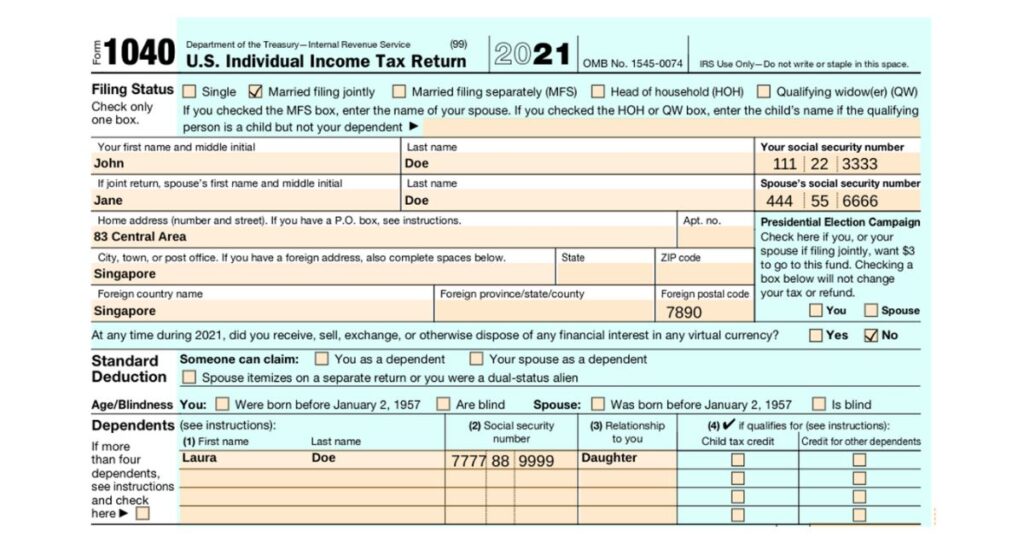

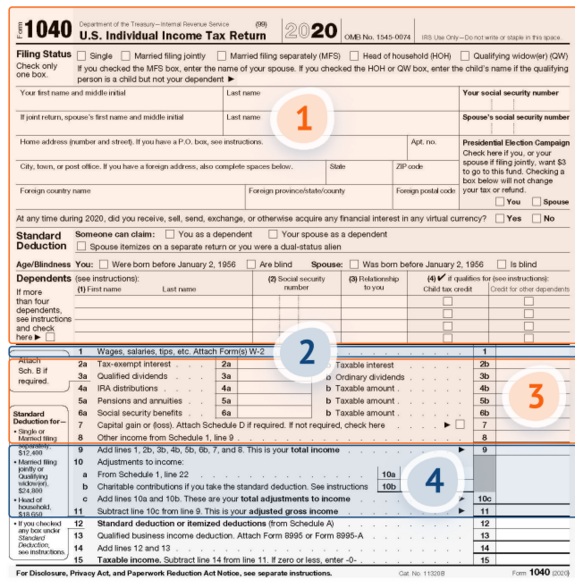

Where revenue connects to services both in the U.S. and outside the united state, the earnings must be allocated. Unique regulations put on Foreign Service and military employees. The exemption is a political election. Taxpayers may declare the exclusion only if they file IRS Form 2555 or Kind 2555-EZ. The type has to be connected to a timely submitted U.S.

Not known Facts About Feie Calculator

Sometimes, the FEIE can even aid you pay much less in tax obligations as a deportee than you would in the United States. Of program, just as with all tax obligation strategies, whether the FEIE is right for you depends on your private situations. While the nitty-gritty information of tax breaks like the FEIE can be complicated, we're here to streamline it for you.

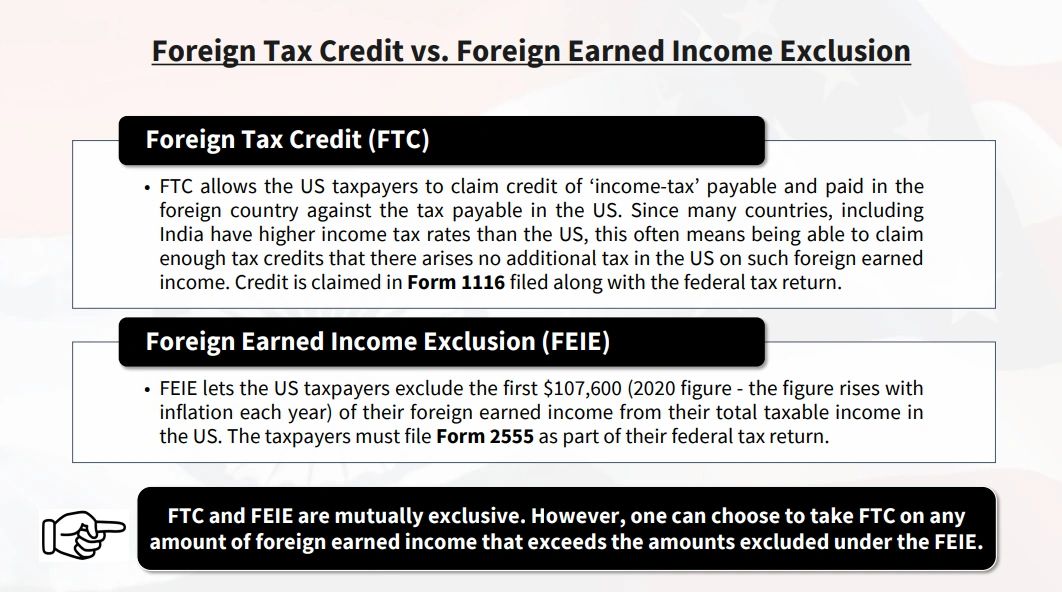

Read on as we break down what the FEIE is, that gets approved for it, just how to claim the exclusion, and more. The FEIE is a significant tax obligation break for deportees that enables Americans to omit a particular amount of their international made income from common government revenue tax obligations. The other crucial tax breaks for expats include the Foreign Tax Credit Rating (FTC) and International Real Estate Exclusion/Deduction (FHE/FHD), both of which we'll go into even more information on later on.

holiday or discontinuance wage) On the other hand, you can not leave out unearned/passive income under the FEIE. Kinds of earnings that are disqualified for the FEIE consist of: Rental revenue Dividends Resources gains Rate of interest from checking account or financial investments Pension/retirement earnings Social Safety advantages Annuities Kid support/alimony Circulations from a count on Note: While unearned revenue doesn't certify for the FEIE, it might receive other tax obligation breaks.

Feie Calculator for Beginners

It does not, nevertheless, omit your revenue from various other kinds of taxes. Self-employed expats who assert the FEIE must still pay a tax of 15.3% (12.4% for Social Protection, 2.9% for Medicare) on their internet self-employment revenue. Keep in mind: Americans functioning abroad for US-based employers are accountable for just 7.65% in US Social Security taxes, as their employers are called for to cover the other 7.65%.

Before you assert the FEIE, you should meet at the very least one of 2 different examinations., you have to be literally existing in an international nation (or countries) for at least 330 full days out of any365-day period that overlaps the pertinent tax year.

Note that only days where you spent all 24 hr beyond the US matter as a full day for the purposes of this examination. Verifying you satisfied the Physical Presence test needs you to log all of the nations you were physically existing in over the relevant 365-day period and just how much time you spent there.

Feie Calculator Things To Know Before You Get This

If so, you will certainly need to full Component VI. In it, you'll share information on your international housing expenses, including just how much you sustained, where you incurred them, and whether your employer reimbursed you for any of them (American Expats).

While most Americans have a tax obligation due date of April 15th, deportees obtain an automated two-month read review expansion until June 15th. Keep in mind: If any of these days drop on a weekend, the tax obligation due date will relocate to the next organization day later.